NIFTY (SPOT) @ 10526

Nifty this week given close around 10526 with negative basis, due to mix global marketsentiments and elections in some states range bound and swing trend is seen and will more

swing will be seen in coming days, this week is it given minor negative closing as upside it

has strong resistance around 10750-10980 and it has weekly trend decider level is 10604 if

it close below then more downside fall we will see in upcoming day’s so don’t carry heavy

position in portfolio downside it will test 10300-10110 so be cautious on higher levels and

sell on rise strategy can be followed, keep close watch on given levels and global market

updates watch out.

BANK @ 25999

Nifty Bank this week given close around 25999 with negative basis below the major

support and trend decider @ 26000, but don’t hurry for fresh buying keep close watch

global market update, upside it has first resistance around 26250 and it has weekly trend

decider level is 25987, if it close below then more downside fall possible up to 25500-25000

so be cautious on higher levels, this week it given close with flat basis due to long covering

move, so keep close watch on given levels, watch out.

TREND DECIDER THIS WEEK 25987

JUSTIFICATION -

PIDILITIND FUT trading above 50 days SMA & close in weekly chart. Also share trading

above major resistance level 1126.20. We have recommended PIDILITIND FUT buy on dip

with target 1171 to 1192 and strong support level is 1083 .

JUSTIFICATION -

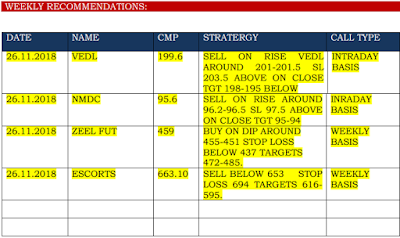

VEDL FUT trading below major support level 201.10 and trading below 50 days SMA.

Also trend line showing selling side in weekly chart. We have recommend sell on rise with

target of 194 to 185 levels. And there is strong resistance level 218.85.

CANDELSTICK CHART :- HDFC LIFE

JUSTIFICATION

This week HDFC LIFE given close around 393.3 with bullish candle due to short covering move and fresh buying also, in daily chart found fresh breakout buy on decline strategy best buying around 388.5-389.5 and keep stop loss of 384 below on closing basis upside it will be test 400-404+ watch out.

CANDELSTICK CHART : WELCORP CASH

JUSTIFICATION

This week WELCORP given close around 159.6+ with bullish candle due to short covering move and fresh buying also, in daily chart found fresh breakout buy on decline strategy best buying around 158.5-159 and keep stop loss of 154 below on closing basis upside it will be test 165-170+ watch out.